NOT KNOWING THE TRUE LANDED COST: A FATAL MISTAKE OF INTERNATIONAL BUSINESS

PRA Global │White Paper

NTRODUCTION

For companies involved in international trade, the cost to get the product to the customer’s doorstep can be significant.

Whether you control the final sales price of your product or not, you must be aware of how that price is determined. Positioning your product against the competition in a specific market depends on this. There are some basic differences in the landed cost analysis between domestic and international markets. Some of them are obvious, like customs duties. Others are not so obvious, like all the fees that may be levied to process customs declarations or to exchange currency. Failing to be aware of all the cost items could be a very expensive mistake.

How can a company avoid this mistake?

Whether you sell through an importer and your involvement ends when the container is loaded on the ship, or you are actively involved in the sale to the end-user; you need to be aware of how the price to the customer is calculated. This is not just a question of assessing the profitability of selling to a specific market; you need to be aware of how your product is positioned against competitors. Whatever the arrangements behind the logistic of delivering your product to the ultimate client, the final price will be a major component of its success. Your P&L analysis may only include the costs incurred until the contractual delivery takes place, but the success of your product in that market depends on the final landed cost to the ultimate client. A realistic projection of sales depends on the awareness of all the costs.

LANDED COST ESTIMATES GONE WRONG

Case 1 – Careless Estimate

A US niche menswear company decided to start approaching markets beyond the US and Canada. They decided to start European sales from the UK, created a local landing page by copying their US page, and changed the currency from $ to £. The higher value in British Pounds was supposed to cover the extra costs once converted to US Dollars. Their assessment did not consider that British customers would have to pay import duties and VAT on their products. Yet this increased their price by 25%, making them uncompetitive for a niche brand entering the market. Orders from the UK disappeared quickly. Their UK advertising costs did not lead to any further sales. The company stopped promoting its products in the British market.

Case 2 – High Landed Costs Estimate

An Italian high-end kitchen furniture company had great interest in their innovative design and space-saving ideas from buyers in the Middle East. It was their first attempt to export, and they were worried about losing money. They were aware of all their cost items but instead of calculating actual costs, they identified a cost range, settling on the higher end of the range so they would not sell at a loss. They arranged to cover the costs up to the Italian port and did not account for any cost incurred by the importer.

The result was an extremely expensive product. A clever social media campaign for a high end, high-tech kitchen did not turn into as many sales as everybody thought, prices were prohibitively high, and potential customers were scared away.

Assessing the True Landed Cost

Once you have decided to sell to a new market you need to define distribution arrangements, contractual arrangements, and any other detail that will ultimately deliver your product to the client’s doorstep. It is important that you analyze the true landed cost associated with each business model, because:

- High landed cost estimates turn clients away

- Low estimates lead to inflated earning projections

- Careless estimates make it impossible to establish proper sales prices and determine product margins

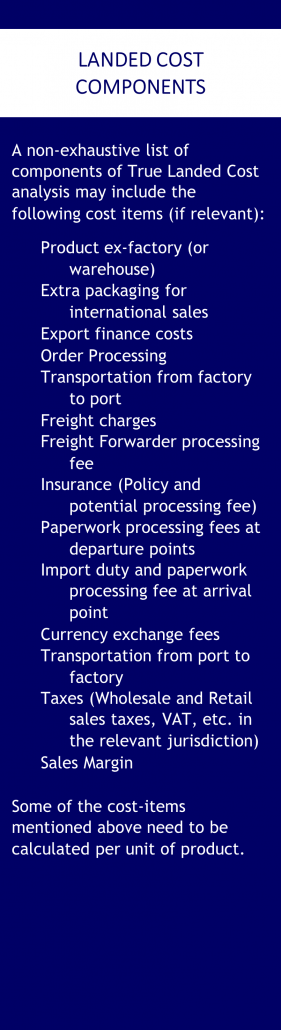

There are three steps to defining the most convenient business model to sell to a specific international market and analyze the true landed cost, and a fourth step makes sure that the analysis stays current.